IBC Case Study 1 - The Average Canadian Family

See how a Canadian family redirects 25% of after-tax income lost to interest, builds a policy, and recaptures debts using a personal banking system.

New to the Infinite Banking Concept? Begin here with our foundational resources

Start with "Becoming Your Own Banker" - the definitive guide to the Infinite Banking Concept. Learn the principles that have helped thousands achieve financial freedom.

Purchase BYOB BookSubscribe to our YouTube channel for weekly videos, case studies, and real-world examples of IBC in action. Visual learning made simple.

Visit YouTube ChannelShort on time? Watch our quick overview video that breaks down the Infinite Banking Concept in just three minutes.

Watch Quick Start

See how a Canadian family redirects 25% of after-tax income lost to interest, builds a policy, and recaptures debts using a personal banking system.

Part 3 of Reading Becoming Your Own Banker breaks down Nelson Nash’s five methods of financing and reveals why owning your own banking system through a participating whole life policy creates lasting control, growth, and financial independence.

Your Infinite Banking journey starts with one book — Becoming Your Own Banker by R. Nelson Nash. Learn why this short read lays the foundation for taking control of your financial future.

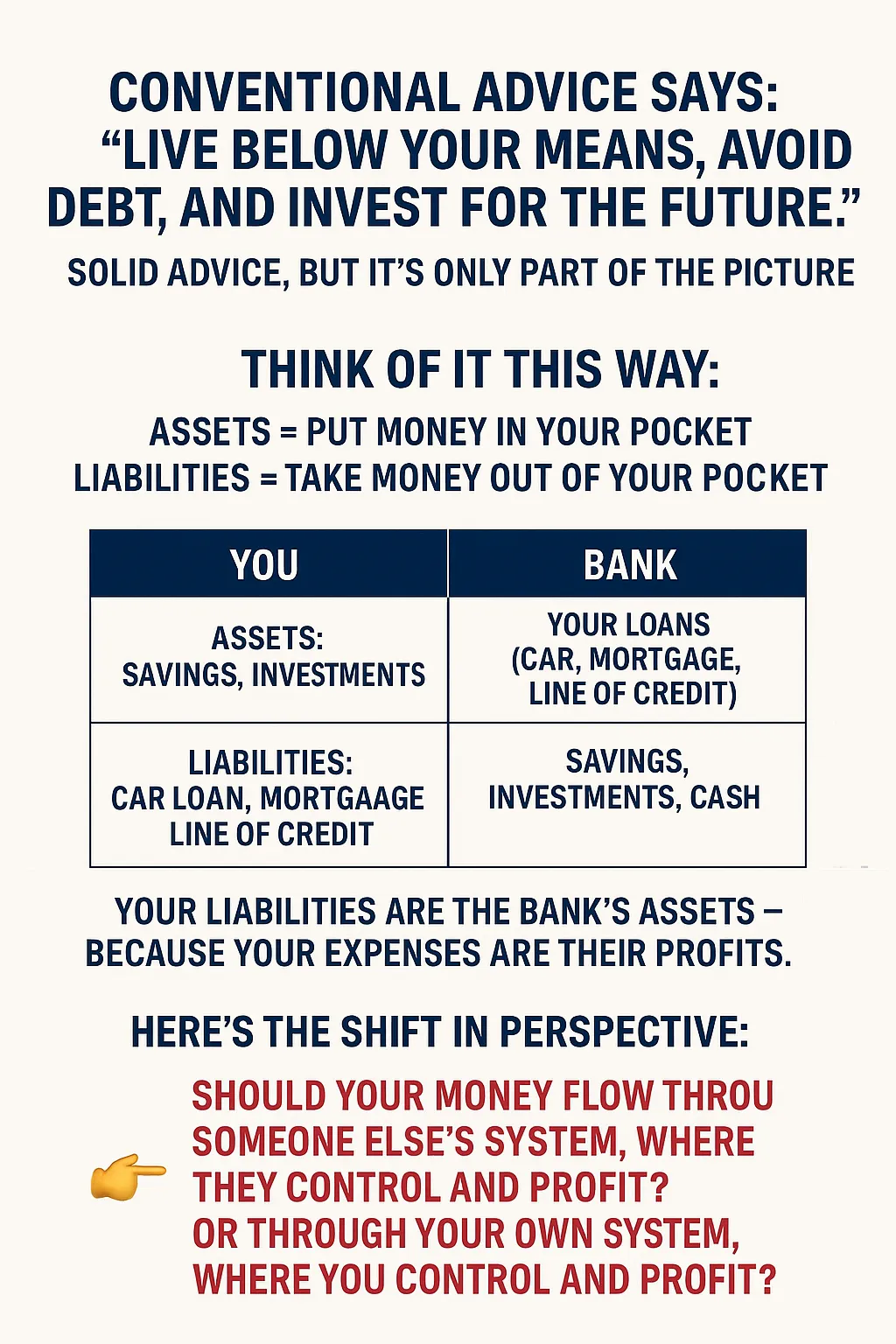

You finance everything you buy—whether with cash or loans. Learn how the Infinite Banking Concept helps you avoid lost opportunity cost, recapture interest, and grow wealth on your terms.

Your savings account keeps money safe but limits growth. Learn how to re-think your emergency fund and use the Infinite Banking Concept to grow wealth while keeping cash accessible.

Banks turn your liabilities into their assets. Learn how to flip the script with the Infinite Banking Concept, turning debt into profit and building a system where you control the flow of money.

Committed to excellence in financial services and client satisfaction.

Contact

FAQ

Privacy Policy